In this article, we’ll cover 5 key features of the cryptocurrency and digital assets industry to highlight its potential as an emerging practice area. We’ll examine unique aspects and legal challenges, demonstrating the opportunities available for legal professionals in this dynamic field.

To really understand cryptocurrency and digital assets as an emerging practice area, you have to understand how things are and have been in other practice areas. As they say, “To know where you’re going, you have to know where you’ve been.”

If you haven’t already, familiarize yourself with the basics of B2C legal marketing. Unlike established fields like personal injury or accident law, the cryptocurrency sector lacks extensive historical marketing data. Therefore, we must seek insights from other sources.

Here are five defining characteristics of the cryptocurrency and digital assets industry:

1. High-Profile Cases

There are a lot of high-profile cases. These cases often revolve around issues such as fraud, money laundering, sanctions violations, and malware, highlighting the complexities and risks associated with digital currencies.

Other examples include the collapse of Mt. Gox, the legal battles faced by the founders of Bitfinex and Tether, and the various charges against executives of major cryptocurrency platforms, Coinbase and Binance.

2. Lobbying and Political Activity

Gone are the days of the frumpy-looking executive meeting financial regulators in dirty sneakers.

The cryptocurrency industry desires a regulatory landscape largely at odds with American securities, commodities, and financial regulations. The industry is keen to change these legal constraints.

Once the medium of exchange on Silk Road, crypto now has an industry profile in OpenSecrets. You might say Sam Bankman-Fried walked so Fairshake PAC could run. There’s no question this industry’s lobbying and influence efforts have matured.

We also observe many justice-involved companies and individuals contributing to the industry’s political action committee:

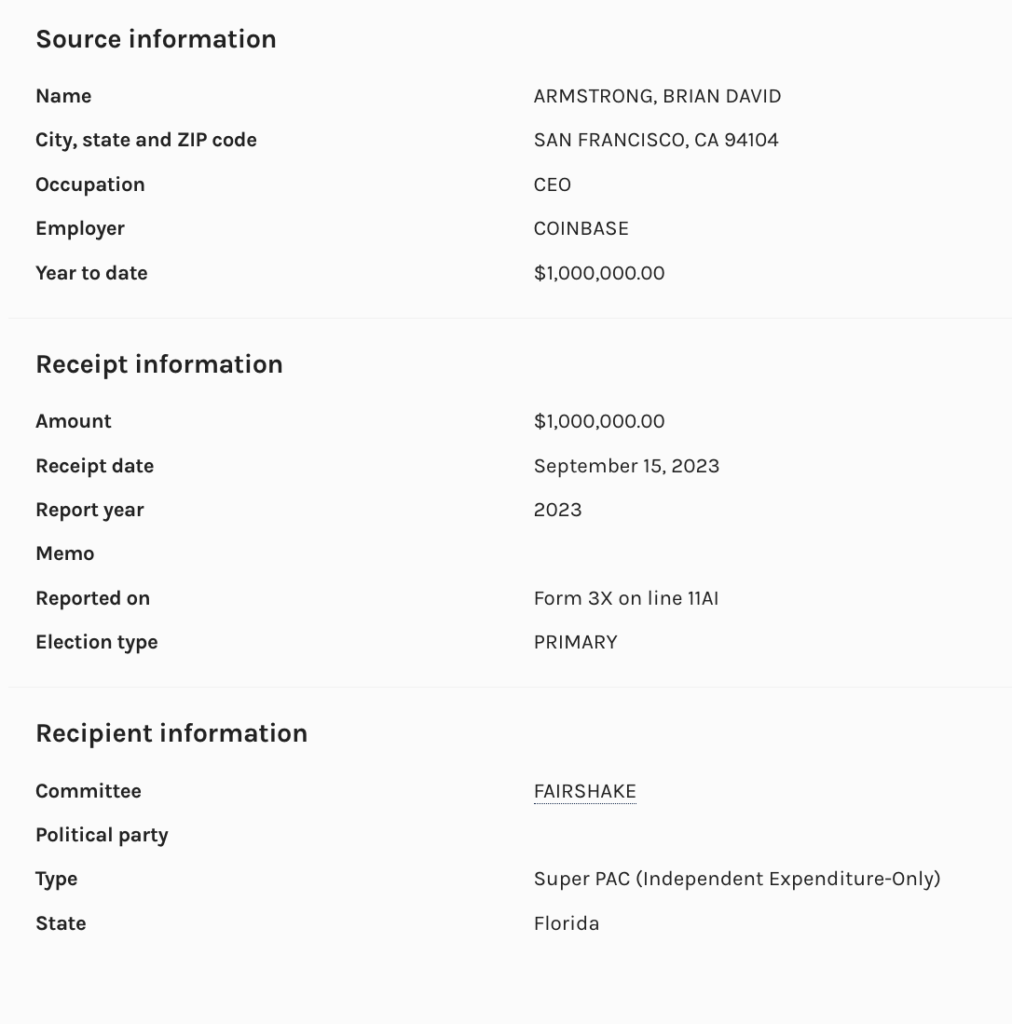

Brian Armstrong

Coinbase CEO Brian Armstrong gave the PAC $1 million as an individual donor.

Find this and all his political donations at the Federal Election Commission.

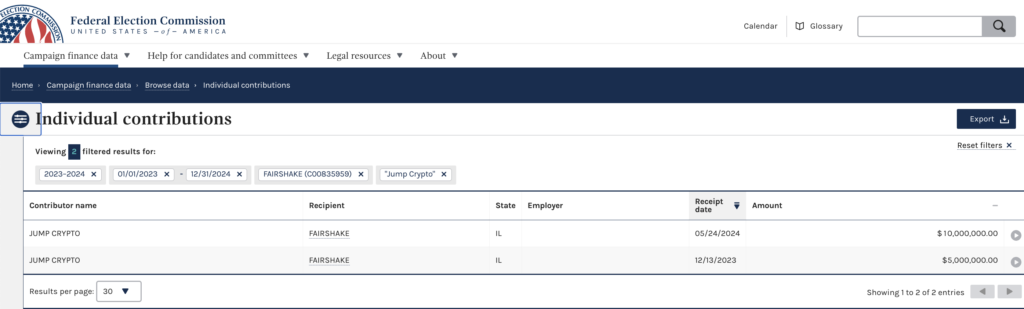

Jump Crypto

The company Jump Crypto gave $15 million to Fairshake PAC.

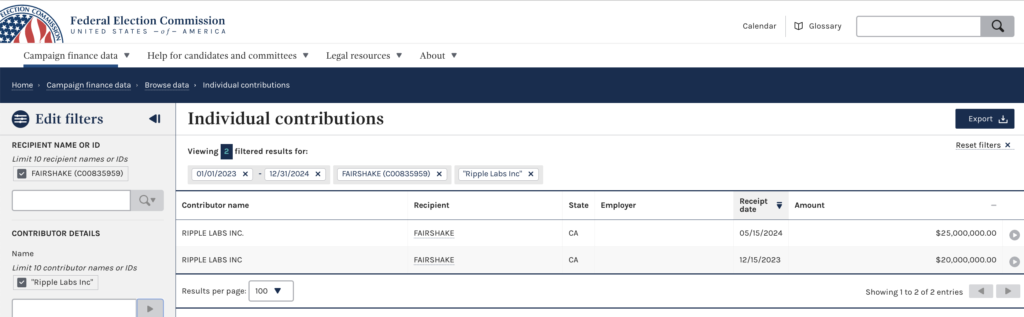

Ripple Labs Inc

This company gave $45 million to the industry PAC.

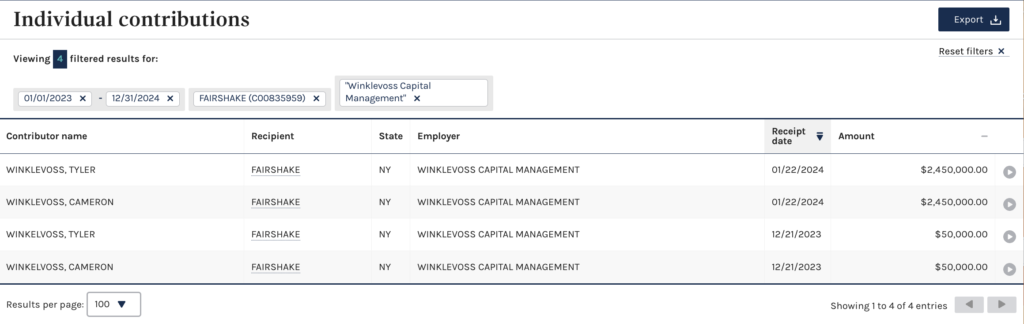

The Winklevoss Twins

Notable Facebook adversaries and former aspiring adult popstars Tyler and Cameron Winklevoss also gave generously to the PAC.

If you want to learn more, Molly White does a great job and has been looking closely at political activity in the crypto space.

3. Known Bad Actors

The cryptocurrency industry has seen its fair share of bad actors. There are high-profile scams, fraudulent exchanges, and YouTube influencers. Federal inmate Steve Bannon is a crypto enthusiast.

4. Digital Asset Investors

Cryptocurrency has garnered significant interest among Americans. Depending on who you ask, there are either 18 million, 52 million, or 93 million American crypto investors.

Compare those numbers to other large, incumbent practice areas. There were just more than 6 million car accidents in 2021. There were almost 3 million work injuries and illnesses in 2022.

5. Search Trends

Lastly, the search volume for specific keywords can provide a strong indicator of market interest and potential for various legal practice areas, including the emerging field of cryptocurrency and digital assets.

Here’s a comparison of search volumes for popular keywords:

DUI

39,100

Monthly Search Volume

Accident

48,100

Monthly Search Volume

Cryptocurrency

214,000

Monthly Search Volume

The high level of interest in cryptocurrency can be attributed to several factors. Given the substantial search volume, prominent industry figures, and significant policy debates, any legal outcomes are likely to have far-reaching implications. This suggests a potentially competitive marketing environment.

The keyword search data is from Spyfu in July, 2024. So is this.

As the field of cryptocurrency and digital assets continues to evolve, it presents both significant challenges and opportunities for legal professionals. By understanding the unique aspects of this industry, lawyers can position themselves at the forefront of an emerging and dynamic practice area. Staying informed about the latest trends and legal developments is crucial for effectively navigating this complex landscape.

Claim your profile in the legal directory for digital asset investors today!